Maximize Your Wealth: Essential Estate Tax Planning Tips for New York Residents

Effective Estate Tax Planning Strategies for New York Residents Planning for estate taxes in New York requires a comprehensive approach to ensure the preservation of

Effective Estate Tax Planning Strategies for New York Residents Planning for estate taxes in New York requires a comprehensive approach to ensure the preservation of

Navigating Dental Practice Purchase Agreements in Hallandale’s Competitive Market The dental industry in Hallandale, Florida, is experiencing a period of dynamic growth and transformation. As

Top Probate Lawyers in New York for 2025 Dealing with probate law can be overwhelming, especially in times of grief. Morgan Legal Group specializes in

Navigating the Complexities of New York Dental Law The practice of dentistry in New York State is governed by a series of rigorous regulations and

Using Captive Insurance Companies in New York for Estate Planning: A Strategic Approach to Risk Management, Control, and Wealth Transfer For business owners in New

Estate Planning Insights from Jeff Bezos The Estate Planning Approach of Jeff Bezos Amazon’s founder,Jeff Bezos,has publicly shared his intention to allocate the majority of

The Biden administration is calling for a comprehensive strategy from Israel to ensure the safety of Palestinian civilians residing in the southern city of Gaza.

The upcoming 2024 election is shrouded in uncertainty, particularly when it comes to the presence of third-party candidates and their placement on the ballot. This

Top Estate Planning Lawyers in Manhattan Securing your future is crucial to safeguarding your assets and ensuring the well-being of your family. At Morgan Legal

In a shocking turn of events, a former Milwaukee election official has been convicted of fraudulently obtaining fake absentee ballots. This scandal has rocked the

Protective Measure Taken to Safeguard Trump’s Assets During Legal Battle In a strategic move to safeguard his assets during a legal battle, a bond was

Estate Planning for Your Digital Assets in New York As our lives become increasingly intertwined with the digital world, it is essential to consider the

New York Trust & Estates Legacy Lawyers: Securing Your Family’s Future for Generations Planning for the future involves more than just accumulating wealth; it’s about

Your Guide to Essential Estate Planning Documents in NY Embarking on the estate planning process can feel like navigating a dense forest of legal jargon

Finding the Best Probate Attorney in NYC: A Comprehensive Overview When faced with the challenging task of navigating the probate process in New York City,

Estate Planning Mistakes to Avoid in New York: Protecting Your Legacy and Ensuring Your Wishes Are Honored To think some estate plan misconceptions and common

The Importance of Updating Your Estate Plan in New York: Planning for 2025 and Beyond Estate planning is not a one-time event; it’s an ongoing

George Santos, a former representative, made a public declaration on Thursday evening regarding his candidacy for the 1st Congressional District in New York. This decision

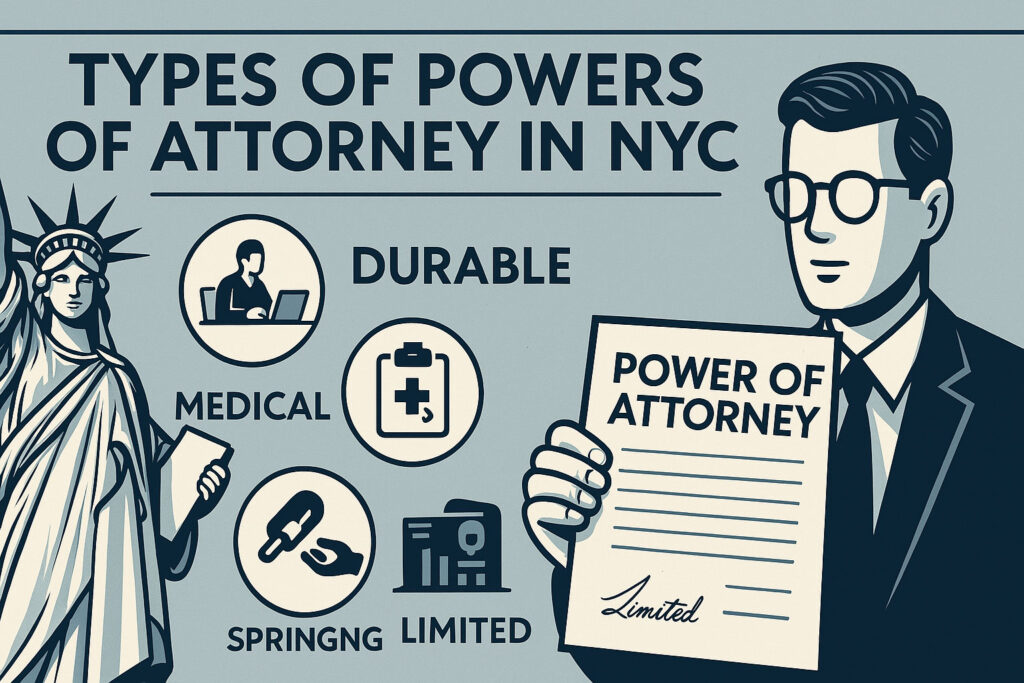

NYC Power of Attorney: A Complete Guide to Protecting Your Future In the bustling city of New York, planning for the unexpected is crucial. A

Business Succession Planning in New York: Ensuring a Smooth Transition and Protecting Your Legacy For business owners in New York, their company represents more than

Navigating Wills and Trusts in New York: A 2024 Guide As we move into 2024, the realm of estate planning in New York is undergoing

The process of probate involves the validation of a Will. When an individual passes away with a Will in place, that Will must undergo probate

The Significance of a Living Will in New York Estate Planning: Looking Ahead to 2025 and Beyond When it comes to estate planning in New

Why You Need a Local 10007 Estate Planning Attorney The 10007 zip code is a unique and powerful corner of Manhattan, a place where historic

Why You Should Let a Probate Lawyer Handle Your Probate Issues Understanding the Probate Process in New York Probate is a legal process that validates

Understanding the Costs of Probate Attorneys in New York City When faced with the responsibility of handling an estate in New York City, one of

New Guidelines from the Supreme Court on Government Officials and Social Media Blocking The Supreme Court recently issued a ruling that clarifies the circumstances under

Many people mistakenly believe that estate planning solely involves creating a will or trust to pass on assets. However, estate planning encompasses a wide range

Understanding the Probate Process Probate is a legal procedure that involves the settlement and distribution of assets and estates to beneficiaries. It entails proving the

An administrative proceeding refers to a legal process conducted by an administrative agency or governmental body to resolve disputes, enforce regulations, or make decisions related

Do you require a probate attorney during estate planning or not? This is a question that confuses many people. However, a probate attorney is a

New Faces and Tough Battles: Primary Challenges in Ohio, Illinois, and California In the upcoming elections, incumbent House members in Ohio and Illinois are encountering